Home loan & finance calculators

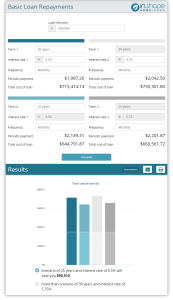

Basic loan repayments

A simple calculator to compare 4 loan scenarios: 2 different interest rates and 2 different terms.

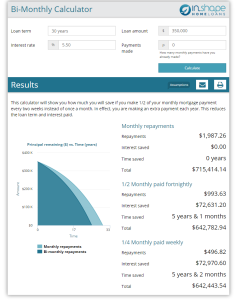

Bi-monthly repayments

Some people choose to pay half of their monthly repayment each fortnight. This in effect gives you an extra repayment every year. You’ll be surprised how much time and interest you can save.

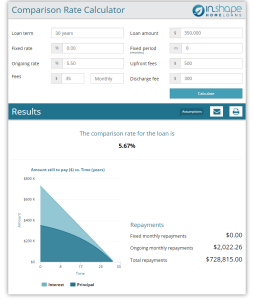

Comparison rate

This comparison rate is designed to reflect the total annual cost to a borrower of a loan. It wraps up interest payments and fees and expresses all these costs in one rate.

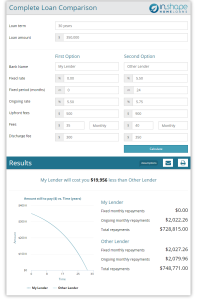

Complete loan comparison

Compare two different loans with honeymoon rates, upfront fees, monthly fees and discharge fees.

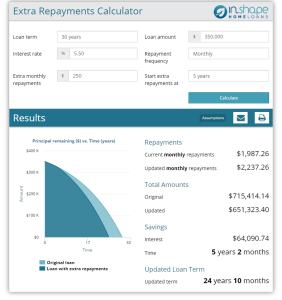

Extra repayments

See how much money you can save when you make extra repayments throughout your loan. How many years can you cut off?

How long to repay

Set the amount you’d like to pay per period and calculate how long it takes to pay off your loan.

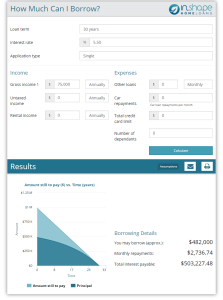

How much can I borrow

Find out the amount you may be able to borrow based on your income, expenses and number of dependants.

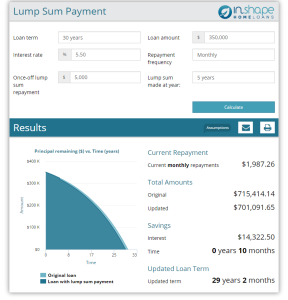

Lump sum payment

What will be the effect on your loan if you pay off a lump sum. The sooner you pay it the more you can save.

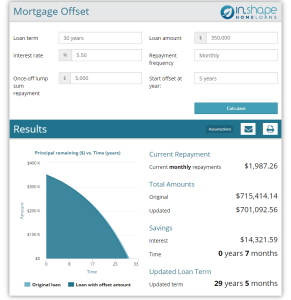

Mortgage Offset

A Mortgage Offset loan has linked account with a credit balance that can help reduce the interest and time taken to pay off your loan.

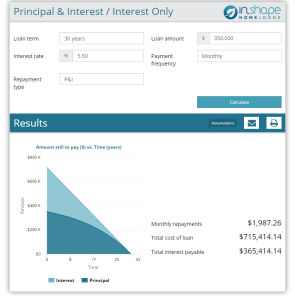

P&I / Interest only

Dual calculator that shows a Principal & Interest loan or just an Interest Only loan.

Stamp duty

Stamp duty, Mortgage Registration Fees and Transfer Fees in each of the states and territories.

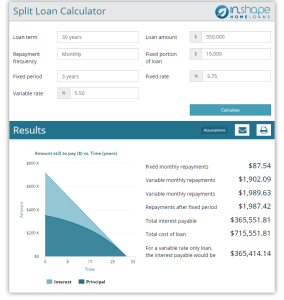

Split loan

A split loan will allow you to fix a percentage of your loan over a period of time. Part of the loan will be at a fixed rate, the other part at a variable rate.

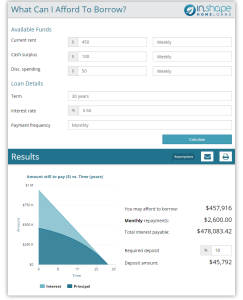

What can I afford to borrow?

Using what you are currently spending on rent and other surplus cash, your borrowing amount is based on what you can physically afford to pay towards a loan.

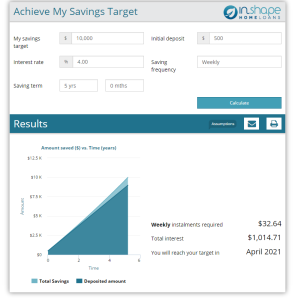

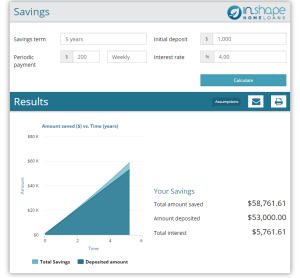

Achieve my savings target

Do you have something important you’d like to save for? Find out how much you need to save periodically to get there.